Sorted by date Results 1 - 25 of 55

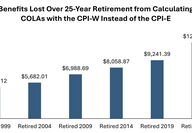

A new analysis from The Senior Citizens League (TSCL) shows the average senior who retired in 1999 has lost nearly $5,000 in Social Security payments as a result of the government using the wrong price index to calculate Cost-of-Living Adjustments (COLAs). The COLA is currently calculated with the CPI-W, a price index that tracks inflation for people who work and live in cities. Instead, it should be using the CPI-E, which is designed to reflect seniors' budgets and tends to...

Increased 2026 tax deductible limits for long-term care insurance have just been announced by the IRS, according to the American Association for Long-Term Care Insurance (AALTCI). “The tax deductibility of tax-qualified long-term care insurance premiums is an incredible benefit potentially for many aging Americans,” said Jesse Slome, director emeritus of the AALTCI. “The 2026 deductible limits are significant and few people, especially small and mid-sized business owners, are aware that premiums paid for long-term care insur...

On July 4, 2025, a landmark piece of legislation known as the One Big Beautiful Bill Act (OBBBA) was signed into law, setting in motion some significant changes to the American financial and healthcare systems. For the nation's retirees and those planning for their golden years, the OBBBA is not just another piece of political news; it is a complex and multifaceted law that will directly impact their financial stability, healthcare access, and long-term planning for years to...

The Social Security Administration announced on October 24 that Social Security benefits, including Old-Age, Survivors, Disability Insurance, and Supplemental Security Income (SSI) payments for 75 million Americans will increase by 2.8% in 2026. On average, Social Security retirement benefits will increase by about $56 per month starting in January. Since 2016, the cost-of-living adjustment (COLA) increase has averaged about 3.1%. The COLA was 2.5% in 2025. Nearly 71 million Social Security beneficiaries will see a 2.8% COLA...

If you’re paying for magazine subscriptions right now, you could be missing out on an opportunity to save money. Many magazines are available for free; you just have to know how to get them. To research this story, I signed up for a handful of online subscription services and called local libraries and booksellers to find out the best ways to get free magazines. In this article, you’ll find three great techniques to secure free magazines, including digital subscriptions, monthly mailed releases and old copies. I searched for...

Now that tax time has come and gone, you may be wondering what to do with all of the legal documents, receipts and business papers you've accumulated over the past 12 months, especially your tax documents. "When you're working on your taxes, you're trying to figure out what can you keep," money expert Clark Howard says. "What can you discard? What had you better keep?" In this article, we'll discuss how long to keep your tax documents and why, according to Clark. Clark mostly subscribes to a "rule of sixes" when it comes to...

What makes for retiring well? For most Americans, it's living a little by affording experiences that bring joy (68%) and enjoying a high quality of life (49%), balanced by the security of reaching savings milestones (68%), according to new Empower research. Most agree satisfaction in retirement includes the ability to pay bills on time and in full (68%) and living debt-free (63%) - including owning a home outright (55%). Some 42% of people say it comes down to experiences,...

A federal grand jury has charged three people with defrauding elderly authors across the United States of almost $44 million by convincing the victims that publishers and filmmakers wanted to turn their books into blockbusters - but only if they paid some fees first. According to the indictment, Gemma Traya Austin of Chula Vista was the organizer and registered agent for PageTurner, Press and Media LLC ("PageTurner"), a Chula Vista company that claimed to be a book publishing...

The IRS has announced increased 2025 tax deductible limits for long-term care insurance. “Tax deductibility of tax-qualified long-term care insurance premiums remains one of the best-kept secrets in financial planning,” said Jesse Slome, director of the American Association for Long-Term Care Insurance (AALTCI). “The 2025 deductible limits are significant and few people, especially small and mid-sized business owners, are aware that premiums paid for long-term care insurance may be tax deductible," he said. The 2025 limit for...

For the 16th year, CSET is offering it's volunteer income tax assistance services (VITA), a free service to those with household incomes less than $67,000. With an army of about a dozen staff and 130 highly trained volunteers, the service generated more than $5 million in refunds for the 4,200 returns submitted last year. Volunteers, which must undergo 32 hours of training to become certified, provide services at locations throughout Tulare and Kings Counties, including at the...

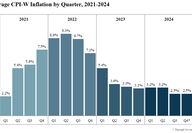

The Senior Citizen's League (TSCL) predicts that the 2026 Cost of Living Adjustment (COLA) will come in at 2.5%, based on the latest Bureau of Labor Statistics data. This figure would be equal to 2025's COLA, signaling modest inflation in the year to come. TSCL will update this prediction every month until the Social Security Administration announces the 2026 COLA in October 2025. In 2024, TSCL's model predicted that inflation, and therefore the COLA, would drop as early as Q2...

"The 2.5% COLA for Social Security benefits in 2025 is nowhere near enough to allow older adults to afford their true cost of living," said Ramsey Alwin, president and CEO of the National Council on Aging, following the announcement of the Social Security cost-of-living adjustment (COLA) for 2025. "The poverty rate for people age 65 and older remained at an unacceptable 14% in 2023," he continued. "Our research with the LeadingAge LTSS Center at UMass Boston shows that about h...

Social Security benefits and Supplemental Security Income (SSI) payments for more than 72.5 million Americans will increase by 2.5% in 2025, the Social Security Administration announced on October 10. On average, Social Security retirement benefits will increase by about $50 per month starting in January. Over the last decade, the cost-of-living (COLA) adjustment increase has averaged about 2.6%. The COLA was 3.2% in 2024. Nearly 68 million Social Security beneficiaries will see a 2.5% COLA beginning in January...

More than 60% of Americans feel they are in a better place to achieve their goals than generations that came before them, according to Schwab's eighth annual Modern Wealth Survey, an examination of how Americans think about saving, spending, investing and wealth. Boomers lead the charge, with 66% believing they are more or as likely as older generations to reach their goals, followed by Gen X (63%), Millennials (62%) and Gen Z (60%). One factor likely driving the positivity...

The Senior Citizens League (TSCL) estimates there will be a substantially lower cost-of-living-adjustment (COLA) for next year after the implementation of the 3.2% COLA in 2024. “The 2025 COLA prediction is about 2.57%, down from 2.63% last month,” said Alex Moore, TSCL statistician and managing partner at Blacksmith Professional Services. "Third-quarter numbers are very important because that's what's compared to the prior year's quarter to get the COLA." The rate of inflation, as measured by the Consumer Price Index use...

Half (48%) of American adults report having been a victim or intended victim of financial exploitation in the past, according to a new report from AARP. While adults ages 18 to 49 are more likely than older adults to lose money from financial exploitation, older adults are more likely to lose larger amounts. "Over the past decade, criminals have become increasingly sophisticated, posing new risks to the hard-earned savings of American adults," said Jilenne Gunther, national...

A reverse mortgage is a loan secured by a home that allows older homeowners to convert home equity into cash. Monthly payments are not required on a reverse mortgage. Rather, the loan comes due (with interest) upon a triggering event, typically the borrower passing away or permanently moving out of the home. Unlike a traditional mortgage, the amount the borrower owes on a reverse mortgage will go up rather than down over time as they receive payments from the lender and intere...

The Social Security Administration announced it will decrease the default overpayment withholding rate for Social Security beneficiaries to ten percent (or $10, whichever is greater) from 100%, significantly reducing financial hardship on people with overpayments. "Social Security is taking a critically important step towards our goal of ensuring our overpayment policies are fair, equitable and do not unduly harm anyone," said Martin O'Malley, commissioner of Social Security....

When you think of new hires, who do you picture? While you may expect applicants to be 20-somethings straight out of college or 30-to-40-somethings making a career change, in reality, you'll likely see more applicants who are older adults. According to a report by the U.S. Special Committee on Aging, workers 55 and older will soon represent 25% of our nation's workforce. However, just because more older adults are applying for jobs doesn't mean they are getting hired. Many old...

Community Services Employment Training (CSET) is currently providing free tax preparation services to residents of Tulare County. The Volunteer Income Tax Assistance (VITA) program prepares federal and state tax returns at no cost to households with less than $60,000 in annual income. Each year, CSET helps thousands of residents in Tulare County file their income tax returns for free. Additionally, tax preparers can help residents claim federal/state earned income tax credits...

I am looking into moving to a Senior Independent/Assisted Living community. Does insurance pay for it? Independent living and assisted living communities in Tulare County are private pay. If you were wise enough to get a long-term care insurance policy that includes residential care facilities, it will help you pay the assisted living fees. Long-term care insurance policies are purchased separately from health insurance and have hefty premiums, but they are life savers when...

Boston College's Center for Retirement Research published a study that explores what Americans think are the biggest risks to their retirement - as opposed to what they objectively are. The center found "a big disconnect between how actual and perceived risks are ranked." That disconnect could be hurting people's retirement planning. The study says the biggest risk to retirement is longevity - living so long that we run out of money. But the survey found that the biggest...

The Centers for Medicare & Medicaid Services (CMS) has announced that average premiums, benefits and plan choices for Medicare Advantage and the Medicare Part D prescription drug program will remain stable in 2024. Improvements adopted in the 2024 Rate Announcement, as well as the 2024 Medicare Advantage and Part D Final Rule support this stability. CMS works to ensure these programs work for people enrolled in Medicare, that benefits remain strong and stable, and that...

Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2% in 2024, the Social Security Administration announced on October 12. On average, Social Security retirement benefits will increase by more than $50 per month starting in January. More than 66 million Social Security beneficiaries will see the 3.2% cost-of-living adjustment (COLA) beginning in January 2024. Increased payments to approximately 7.5 million people receiving SSI will begin on December 29. (Some...

The Social Security cost of living adjustment (COLA) for 2024 is looking increasingly like it may be around 3%, based on consumer price data released on August 10, according to The Senior Citizens League (TSCL). Overall, the inflation rate in July is significantly lower than a year ago. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the index used to determine the COLA, was up 2.6% year over year. However, the average monthly inflation rate has risen slightly, especially since January of this...